In today’s fast-paced digital business environment, financial accuracy and efficiency are no longer optional—they are essential for growth, compliance, and long-term sustainability. Traditional bookkeeping methods, which rely heavily on manual recordkeeping, spreadsheets, and isolated financial systems, are becoming increasingly outdated. Errors, delays, and inefficiencies can easily arise, impacting cash flow, reporting accuracy, and decision-making.

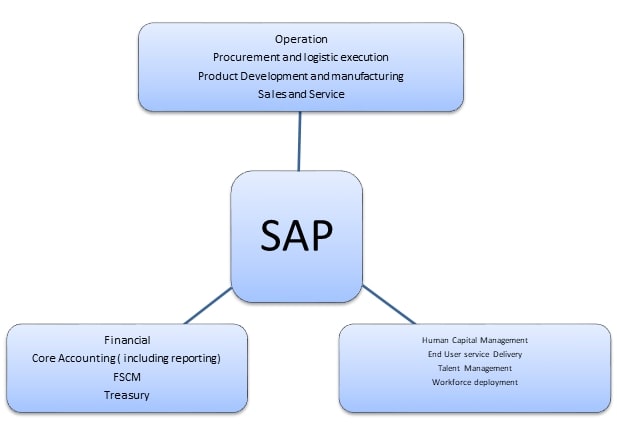

This is where SAP bookkeeping services come into play. SAP—one of the world’s most powerful Enterprise Resource Planning (ERP) systems—offers advanced tools that streamline bookkeeping tasks, increase accuracy, enhance visibility, and support modern businesses like never before. When managed by trained SAP bookkeeping experts, the system becomes a reliable financial backbone for companies of all sizes.

So, what actually makes SAP bookkeeping services more reliable than traditional methods? Let’s dive deep into the key reasons.

1. Centralized Financial Data Management

One of the biggest challenges with traditional bookkeeping is data fragmentation. Businesses often store financial records in separate spreadsheets, documents, or isolated software tools. When information is scattered, errors and inconsistencies are almost guaranteed.

SAP bookkeeping services, on the other hand, offer a fully integrated and centralized financial ecosystem. All financial modules—accounts payable, accounts receivable, general ledger, inventory, asset management, and payroll—interact with one another in real time.

This eliminates:

-

Duplicate entries

-

Missing data

-

Conflicting financial records

-

Manual consolidation

With everything stored in one unified system, bookkeeping becomes far more accurate, organized, and reliable.

2. Real-Time Processing and Reporting

Traditional bookkeeping often involves manual entries that need to be reviewed and posted at the end of each day, week, or month. This delay can create serious problems—especially when businesses need real-time insights to make fast decisions.

SAP bookkeeping services solve this issue through real-time data processing.

Every transaction—whether it’s a sale, purchase, invoice, payment, or journal entry—updates instantly across all relevant modules. This ensures:

-

Always up-to-date financial data

-

Faster reconciliations

-

Immediate reporting

-

More accurate forecasting

Managers no longer need to guess their financial position. With SAP, they have real-time visibility into cash flow, expenses, revenue, and financial performance.

3. Automation That Reduces Human Error

Manual bookkeeping relies heavily on human input, which increases the risk of mistakes such as:

-

Typographical errors

-

Duplicate entries

-

Incorrect categorization

-

Miscalculations

-

Lost receipts or documents

SAP bookkeeping services automate many of the steps that traditionally require manual work. Automation features include:

-

Auto-posting transactions

-

Automated invoice processing

-

Pre-configured tax calculations

-

Automatic reconciliation

-

AI-based error detection

-

Workflow-based approvals

By reducing manual input, the system minimizes errors and ensures consistent, accurate financial records.

4. Strong Internal Controls and Audit Trails

Financial transparency and compliance are major concerns for any business. Traditional bookkeeping methods often lack the internal controls needed to ensure accountability and proper authorization.

SAP bookkeeping services provide advanced built-in internal control features, including:

-

Role-based access control

-

Automated approval workflows

-

Segregation of duties

-

Encrypted financial data

-

Real-time monitoring of unusual transactions

Every financial transaction in SAP creates a permanent audit trail, including:

-

Who posted the entry

-

When it was created

-

What changes were made

-

Who approved it

These features help organizations remain compliant with regulations, reduce fraud risks, and ensure financial integrity.

5. Enhanced Accuracy Through Integration With Other Business Functions

Traditional bookkeeping often struggles to stay connected with other business departments. For example, sales and accounting may use different systems, requiring manual reconciliation.

SAP integrates bookkeeping with every major business function, including:

-

Sales and distribution

-

Purchasing and procurement

-

Inventory and warehousing

-

Manufacturing

-

HR and payroll

-

Asset management

This integration ensures each department automatically updates financial records as activities occur. The result:

-

No missing data

-

No manual syncing

-

Faster reporting

-

Accurate financial statements

Because SAP acts as a unified platform, the financial data is always aligned with actual business operations.

6. Streamlined Month-End and Year-End Closing

For many businesses, month-end and year-end closing are stressful and time-consuming processes. Traditional bookkeeping often involves:

-

Tracking down missing documents

-

Reconciling outdated spreadsheets

-

Fixing manual entry errors

-

Validating discrepancies

SAP bookkeeping services reduce this stress through automation and real-time posting. Since data is updated continuously, much of the closing work is completed automatically.

SAP also offers:

-

Automated account reconciliation

-

Fixed asset depreciation calculations

-

Financial consolidation tools

-

Multi-currency support

-

Automated adjustments and accruals

These features make the closing process faster, more accurate, and more efficient.

7. Greater Financial Visibility for Smarter Decision-Making

A key limitation of traditional bookkeeping is limited visibility. Often, managers rely on outdated reports or incomplete data, making informed decisions difficult.

SAP provides a variety of analytical tools and dashboards, including:

-

Real-time KPIs

-

Profitability reports

-

Cash flow projections

-

Budget vs. actual comparisons

-

Departmental performance analytics

These insights help businesses:

-

Identify trends early

-

Control costs effectively

-

Reduce risks

-

Make informed strategic choices

With SAP bookkeeping services, decision-making becomes data-driven and proactive rather than reactive.

8. Scalability for Growing Businesses

Traditional bookkeeping systems can become overwhelming as a business grows. More transactions, more employees, more products, and more locations require a scalable system.

SAP is designed to grow with your business. Whether you’re a small company or a large enterprise, SAP bookkeeping services can handle:

-

Increased transaction volumes

-

Multi-location operations

-

Multi-currency transactions

-

Multiple legal entities

-

Global tax regulations

This scalability ensures businesses never “outgrow” their bookkeeping system.

9. Enhanced Compliance and Global Standardization

Compliance with financial regulations has become increasingly complicated. Traditional bookkeeping may struggle to keep up with frequent changes in:

-

Tax laws

-

Reporting standards

-

International financial regulations

-

Industry-specific requirements

SAP bookkeeping services include built-in compliance with:

-

IFRS

-

GAAP

-

GST/VAT regulations

-

Local tax requirements

Automatic updates and standardized processes ensure businesses always remain compliant.

10. Reduced Operational Costs

While traditional bookkeeping may seem cost-effective initially, the hidden expenses—errors, inefficiencies, slow reporting, and compliance risks—often cost businesses much more in the long run.

SAP bookkeeping services reduce costs by:

-

Minimizing manual labor

-

Improving accuracy

-

Preventing compliance errors

-

Reducing audit hours

-

Streamlining workflows

In addition, outsourcing SAP bookkeeping services can significantly reduce overhead costs related to staffing and training.

11. Future-Ready With AI and Machine Learning Integration

SAP is continuously evolving. Modern SAP systems integrate with AI, machine learning, and predictive analytics to further enhance:

-

Cash flow forecasting

-

Fraud detection

-

Anomaly identification

-

Automated reporting

-

Predictive budgeting

Traditional bookkeeping methods simply cannot match this level of innovation.

Final Thoughts

SAP bookkeeping services offer a powerful, reliable, and future-ready solution compared to traditional bookkeeping methods. With centralized data, automation, real-time reporting, strong internal controls, scalability, and advanced analytics, SAP helps businesses achieve greater accuracy, efficiency, and financial visibility.

As organizations grow and financial processes become more complex, SAP’s robust bookkeeping capabilities provide the foundation needed to stay competitive, compliant, and profitable.

Leave a Reply